In recent times, Kenya’s small businesses have found themselves standing at a critical juncture, wrestling with the repercussions of increased taxation and transaction fees imposed by both the government and the Kenya Revenue Authority (KRA).

Confronted with elevated tax rates, numerous businesses have taken a dramatic step by shunning mobile payment solutions like Lipa na M-Pesa and paybills in favor of traditional cash transactions.

This behavioral shift is a direct reaction to the government’s decision to elevate the turnover tax for small businesses from 1 percent to 3 percent of their total annual sales. The government’s intention was to enhance its revenue streams, but it has inadvertently led to unforeseen consequences. Small businesses, striving to safeguard their profit margins, have opted for cash payments to circumvent the supplementary costs tied to digital transactions.

Business owners frequently cite the mounting expenses associated with mobile and online transactions as the primary driving force behind this transition. These augmented fees have eroded the appeal of digital payment methods for both merchants and consumers.

Consequently, businesses have started openly advocating for cash payments or direct withdrawals from their customers, sidestepping the digital platforms that were once ubiquitous in the Kenyan marketplace.

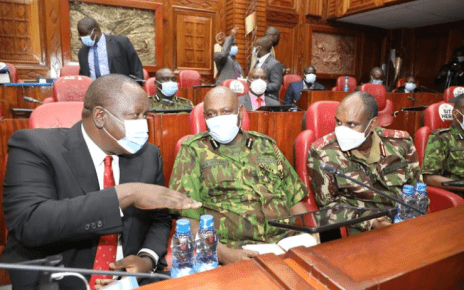

This shift in payment behavior has not gone unnoticed by the authorities. In a bid to ensure tax compliance and that businesses fulfill their tax obligations, the KRA has announced plans to collaborate with Safaricom, the company responsible for M-Pesa.

The objective is to identify businesses that have abandoned mobile payment methods. By compiling a comprehensive list of these enterprises, the KRA intends to undertake rigorous follow-ups and compliance checks.