Money Problems: I live in Gwa Kairu, Ruiru, along the Thika Super Highway and work as a HR assistant in Nairobi CBD. I earn a monthly net salary of Sh. 45,000. Every month, I use Sh. 8,000 to rent my one bedroom self-contained house, Sh. 9,000 on supper and lunch. Sh. 850 on the 6kg cooking gas, Sh. 1,000 to settle power bills, Sh. 600 for my water bill, Sh. 9,000 for my Sacco loan, Sh. 4,000 for transport, Sh. 2,000 for my dreadlocks and nails maintenance, Sh. 3, 000 for new clothes, Sh. 4,000 for my tithe, and I send Sh. 2, 000 to my parents. I am left with Sh. 1,550, of which I only save Sh. 500 and spend the rest on airtime and minor emergencies. I regret taking a two-year loan of Sh. 200,000 in January 2020 to start a side hustle boutique that collapsed after six months. I would like to pay off the loan quickly and save at least Sh. 400,000 so that I can acquire a small plot in Kamulu in the next two years. How can I achieve this?

********

Money Problems: The Solutions

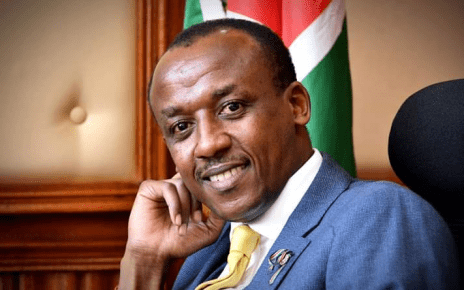

Robert Ochieng’

I commend you for using less than 20 per cent of your net salary on rent. That is below the tolerated levels of 25 per cent for all income levels. The problem with your money lies in your savings. You are currently saving only about 1 per cent of your net pay. The universal standard for saving is 10 per cent but for true financial freedom within 10-15 years, you should strive to save at least 20 per cent of your net pay or more. You should save and invest at least Sh. 4,500 per month. This is money you need to get from your net pay. Check your expenses on clothes. With your budget, Sh. 3,000 is a lot of money to spend on clothes in a month. While I don’t suggest you dress like a nun, your income doesn’t allow you to keep up with every fashion trend. It’s financially draining. Reduce the cost of lunch and supper, especially now that you are alone. Should you start a family, this expense will double and you will border on a financial cliff. From Sh. 9,000, you can squeeze out Sh. 2,500 savings by carrying packed lunch to work. Eating your own cooked food is not only cheap but healthy. These two areas alone should give you Sh. 4,000 to bring your total monthly savings to Sh. 4,500. Since you save with a Sacco, your target should be Sh. 150,000 so that you can be eligible to a facility that is four times the amount you have saved. Within two years, your Sh. 4,500 monthly savings will give you access to a facility of between Sh. 324,000 (three times your savings) and Sh. 432,000 (four times your savings). Assuming that you have paid off 16 months out of your 24-month Sacco loan, it is safe to say you have settled over half of your debt. Once you conclude paying off this loan, channel the extra money you have been using for loan repayment to your savings. This will give you an extra Sh. 9,000 in a year and take you closer to your goal faster.

Chacha Nyaigoti Bichang’a

Your monthly savings of Sh. 500 is too insignificant. It translates to just 1.1 per cent of your net salary which is far below the bare minimum of 10 per cent. This means that you don’t have an emergency fund equivalent to 3 to 6 months of your gross salary. You need to stop saving after spending. To achieve your Sh. 400,000 saving challenge, you need to start by reducing meals and transport budget by Sh. 4,000. This is doable through shopping for foodstuff in bulk, carrying packed lunch to work, avoiding unbudgeted eat outs, and traveling during off peak hours. Use the extra Sh. 4,000 you get from these cuts to top up on your loan repayments so that your repayments are Sh. 13,000 instead of Sh. 9,000. Have the extra Sh. 4,000 go to your principal repayment. This method can save you nearly five months of repayments on a two year loan of Sh. 200,000. Once the loan is settled, save Sh. 13,000 for a period of 31 months. You’ll have about Sh. 403,000 and be debt free. This amount can be higher if invested in a fund that compounds interest such as a Money Market Fund. Saving it in a Sacco will also earn you dividends and allow you to access up to Sh. 1.2 million in loan. Be careful about bad debt, now that you’re paying off a loan for a collapsed business. Always do your due diligence before taking and using loans. When you get to your goal, evaluate if it is viable to buy the plot or not, and whether there are more viable investment options in the market. Two years is a long time and market and investment dynamics are changing daily.

Money Problems: A version of this feature was first published in the Saturday Magazine. The Saturday Magazine is a publication of the Nation Media Group.